If you’re considering a personal loan from KreditBee, understanding the eligibility criteria is crucial. This guide breaks down everything you need to know to assess your chances and prepare effectively.

ಈ ಕೆಳಗಡೆ ಕ್ರೆಡಿಟ್ ಬಿ ಆಪ್ ಮೂಲಕ ತಕ್ಷಣ ಹೇಗೆ ಲೋನ್ ಪಡೆದುಕೊಳ್ಳಬೇಕು ಎಂಬುದರ ಕುರಿತು ಸಂಪೂರ್ಣ ಮಾಹಿತಿಯನ್ನು ತಿಳಿಸಲಾಗಿದೆ.! ಲೋನ್ ಬೇಕಾದವರು ಇಂದಿನ ಈ ಒಂದು ಲೇಖನವನ್ನು ಓದಿ ಅರ್ಧಿ ಸಲ್ಲಿಸಬಹುದು.!!

What Is KreditBee?

KreditBee is a digital lending platform in India that offers personal loans ranging from ₹1,000 to ₹2 lakh. The platform caters to both salaried and self-employed individuals, providing quick and easy access to funds through a fully online process. With flexible repayment tenures and competitive interest rates, KreditBee aims to make borrowing hassle-free.

Personal Loan Eligibility Criteria

To qualify for a personal loan with KreditBee, you must meet the following criteria:

- Age: Between 21 and 60 years.

- Citizenship: Must be an Indian citizen.

- Income:

- Minimum monthly income: ₹10,000.

- Minimum monthly household income: ₹25,000.

- Employment:

- Salaried employees: At least 2–3 months of work experience with your current employer.

- Self-employed individuals: A stable income source and business continuity.

- KYC Documents:

- Identity proof: PAN card.

- Address proof: Aadhaar card, passport, or utility bill.

- Photograph: A recent selfie.

- Bank account details: For loan disbursement.

How to Check Your Eligibility

KreditBee offers an online eligibility calculator to help you assess your loan eligibility. Here’s how it works:

- Visit the Eligibility Calculator: Go to the KreditBee personal loan eligibility calculator page.

- Enter Your Details: Provide information such as your monthly income, existing EMIs, age, and employment type.

- Get Your Estimate: The calculator will provide an estimated loan amount you may qualify for.

Keep in mind that this is just an estimate. Final eligibility is determined after a thorough review of your application and documents.

Factors Affecting Your Eligibility

Several factors can influence your eligibility and loan terms:

1. Credit Score

While KreditBee doesn’t specify a minimum credit score, a higher score generally improves your chances of approval and may result in better interest rates. A score below 650 could be a red flag.

2. Income Stability

Lenders prefer applicants with a stable and sufficient income to ensure timely repayment. A fluctuating income or low salary may reduce your eligibility.

3. Employment Status

A steady job with a reputable employer adds credibility to your application. Frequent job changes or gaps in employment can be viewed negatively.

4. Debt-to-Income Ratio

If you have existing loans or EMIs, they can affect your eligibility. A high debt-to-income ratio may indicate financial strain, making lenders hesitant.

5. Age

Being too young or too old can impact your loan approval. KreditBee prefers applicants between 23 and 58 years, as this range typically indicates a balance between earning potential and repayment capacity.

Documents Required

To apply for a personal loan with KreditBee, you’ll need to submit the following documents:

- Identity Proof: PAN card (preferred), Aadhaar card, passport, or voter ID.

- Address Proof: Aadhaar card, passport, voter ID, or utility bill.

- Income Proof:

- Salaried individuals: Salary slips or bank statements.

- Self-employed individuals: Business financials or bank statements.

- Photograph: A recent selfie.

- Bank Account Details: For loan disbursement.

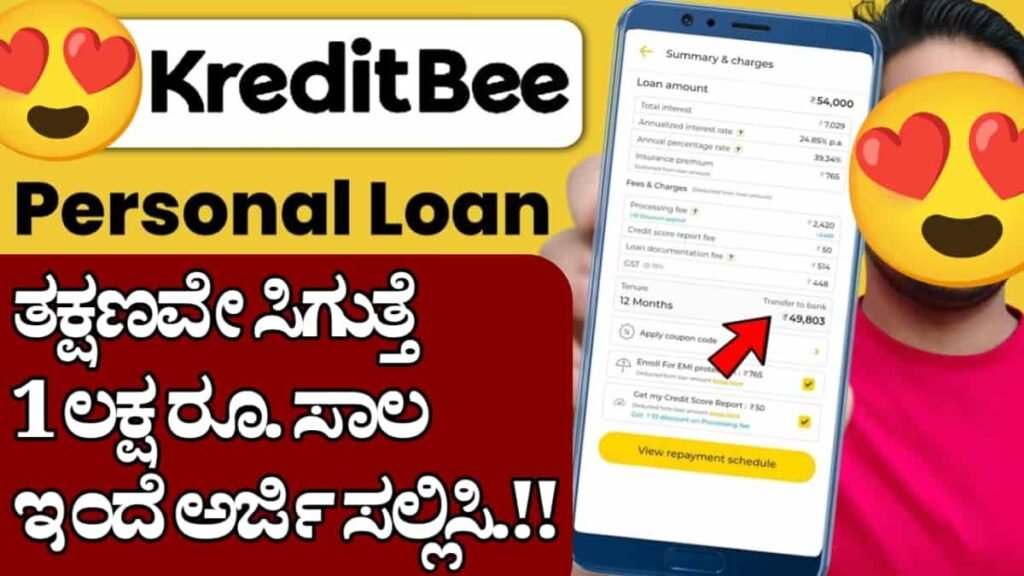

Loan Amount and Tenure

KreditBee offers personal loans with the following features:

- Loan Amount: ₹1,000 to ₹2 lakh.

- Interest Rate: Starting from 12.24% per annum.

- Repayment Tenure: Ranges from 2 months to 15 months.

- Processing Fee: Up to 5.1% + GST.

The exact loan amount, interest rate, and tenure depend on your eligibility and the loan product you choose.

How to Apply

Applying for a personal loan with KreditBee is straightforward:

- Sign Up: Create an account using your mobile number.

- Check Eligibility: Use the online eligibility calculator to assess your loan amount.

- Upload Documents: Submit the required KYC and income documents.

- Verification: KreditBee will verify your information.

- Approval and Disbursement: Upon approval, the loan amount will be disbursed to your bank account, often within 10 minutes.

Tips to Improve Your Eligibility

If you don’t meet all the eligibility criteria, consider the following tips:

- Improve Your Credit Score: Pay off existing debts and avoid late payments.

- Increase Your Income: Seek additional sources of income or negotiate a raise.

- Reduce Existing EMIs: Pay off smaller loans or credit card dues to lower your debt-to-income ratio.

- Maintain Employment Stability: Stay with your current employer for a longer duration to show job stability.

Common Mistakes to Avoid

- Multiple Loan Applications: Applying for loans with multiple lenders simultaneously can negatively impact your credit score.

- Incomplete Documentation: Ensure all required documents are submitted to avoid delays.

- Overestimating Loan Eligibility: Borrowing more than you can repay can lead to financial strain.

Conclusion

KreditBee offers a convenient platform for personal loans, but understanding and meeting the eligibility criteria is essential for approval. By assessing your financial situation, preparing the necessary documents, and following the application process carefully, you can increase your chances of securing a loan that meets your needs.

Remember, borrowing responsibly is key to maintaining financial health. Always assess your repayment capacity before taking on new debt.